Our weekly newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a weekly period.

- Top 20 Loan Price Losers

- Average Bid Price (By industry sector)

- Market Sentiment

- Top Quote Volume Movers

- Most Quoted Loans

- Bid and Offer Volume

- Bid Offer Spread (By industry sector)

Given the severe repricing of risk over the past week, there were insufficient loans to compile a weekly winners list and thus we modified our weekly summary to provide the Top 20 Losers.

| TOP 20 LOSERS | ||||

| Rank | Loan | Chg | Price | Price - 1W |

| 1 | FIELDWOOD ENERGY EXIT 2ND LIEN TL | -56.13% | 21.79 | 49.67 |

| 2 | CRESTWOOD MIDSTREAM TL B | -36.64% | 54.96 | 86.74 |

| 3 | VUE INTERNATIONAL BIDCO PLC EUR TL B | -35.83% | 60.47 | 94.24 |

| 4 | CINEWORLD EUR TL B | -34.05% | 59.63 | 90.42 |

| 5 | 24 HOUR FITNESS TL B | -31.38% | 40.90 | 59.60 |

| 6 | CALIFORNIA RESOURCES TL | -31.18% | 46.96 | 68.24 |

| 7 | GULF FINANCE TL | -30.11% | 51.22 | 73.29 |

| 8 | BCP RENAISSANCE TL B | -29.72% | 56.81 | 80.83 |

| 9 | LIMETREE BAY TL B | -29.19% | 63.88 | 90.21 |

| 10 | BUCCANEER TL | -29.13% | 63.28 | 89.30 |

| 11 | EIF VAN HOOK HOLDINGS TL B | -29.01% | 63.28 | 89.14 |

| 12 | ACCURIDE TL B | -28.88% | 45.20 | 63.55 |

| 13 | MEDALLION MIDLAND TL B | -28.33% | 60.07 | 83.81 |

| 14 | PEAK 10 2ND LIEN TL | -28.25% | 31.23 | 43.52 |

| 15 | CHESAPEAKE ENERGY TL | -28.02% | 42.56 | 59.13 |

| 16 | EAGLECLAW TL B | -27.26% | 59.86 | 82.29 |

| 17 | UTEX TL B | -26.98% | 48.86 | 66.92 |

| 18 | AMF BOWLMOR TL B | -26.97% | 68.82 | 94.24 |

| 19 | COMEXPOSIUM SA EUR TL B | -26.07% | 70.99 | 96.02 |

| 20 | BLACKSTONE CQP TL B | -25.55% | 64.62 | 86.79 |

- Showcases the top 20 loan "losers" based on the largest bid price decreases between 3/13/20 - 3/20/20

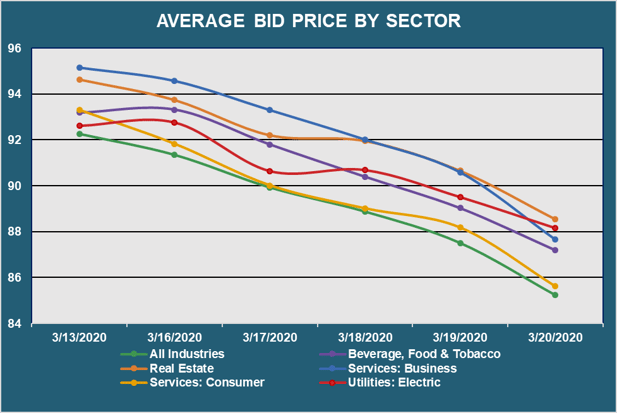

- Displays the average loan bid price by sector between 3/13/20 - 3/20/20

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

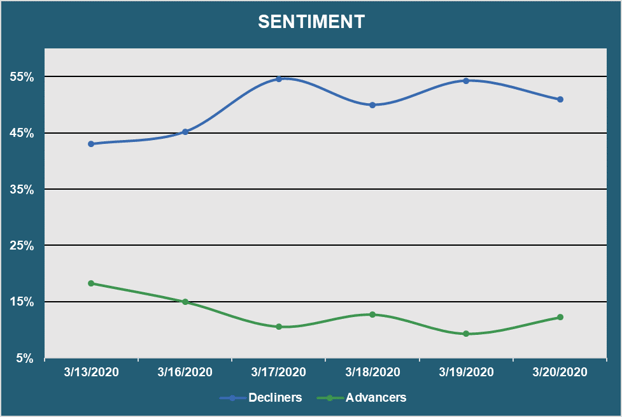

- Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 3/13/20 - 3/20/20

| TOP QUOTE VOLUME MOVERS: THIS WEEK vs LAST WEEK | |||||

| RANK | TRANCHE |

PRIOR WEEK |

THIS WEEK |

INCREASE | % INCREASE |

| 1 | HILTON TL B | 32 | 57 | 25 | 78% |

| 2 | ARISTOCRAT TL B | 27 | 50 | 23 | 85% |

| 3 | VERITAS TL B1 | 10 | 31 | 21 | 210% |

| 4 | EG GROUP TL B | 15 | 35 | 20 | 133% |

| 5 | HERBALIFE TL B | 15 | 35 | 20 | 133% |

| 6 | GRAY TELEVISION TL C | 24 | 42 | 18 | 75% |

| 7 | HEARTHSIDE FOODS TL B2 | 26 | 44 | 18 | 69% |

| 8 | PLAYTIKA HOLDING CORP TL B | 16 | 34 | 18 | 113% |

| 9 | SS&C TECH TL B5 | 9 | 27 | 18 | 200% |

| 10 | STAPLES TL B1 | 25 | 43 | 18 | 72% |

- Exhibits the loans with the largest increase in quote volume for the week ending 3/13/20 vs. the week ending 3/20/20

| MOST QUOTED LOANS | ||

| RANK | TRANCHE | DEALERS |

| 1 | ACTION NEDERLAND EUR TL B | 17 |

| 2 | AMC ENTERTAINMENT TL B1 | 16 |

| 3 | TECHEM EUR TL B | 16 |

| 4 | VERISURE MIDHOLDING AB EUR TL B1 | 15 |

| 5 | SIGMA BIDCO EUR TL B | 14 |

| 6 | NESTLE SKIN HEALTH EUR TL B | 14 |

| 7 | HARLAND CLARKE TL B7 | 14 |

| 8 | ELSAN GROUPE EUR TL B | 14 |

| 9 | WEBHELP EUR TL B | 14 |

| 10 | FRONERI EUR TL B | 14 |

- Ranks the loans that were quoted by the highest number of dealers between 3/13/20 - 3/20/20

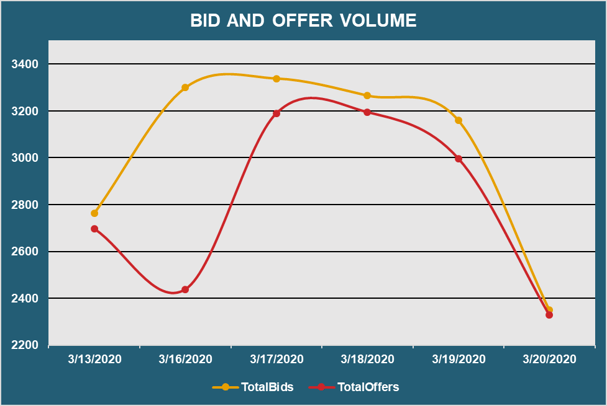

- Reveals the total number of quotes by bid and offer between 3/13/20 - 3/20/20

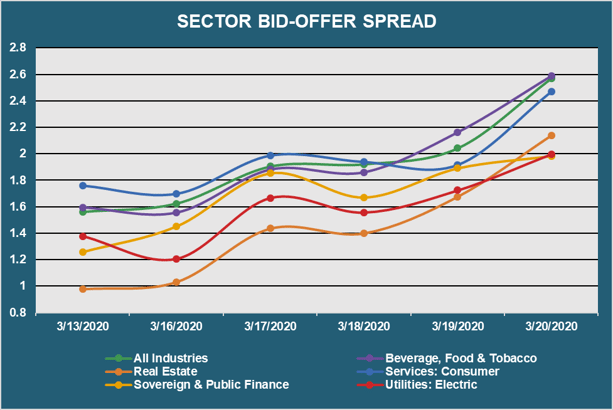

- Displays the bid-offer spread by sector between 3/13/20 - 3/20/20

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Want free access to Real-Time Composite pricing and trends within the market for Syndicated Bank Loans?

If you would like to see additional information, or if you have any feedback or questions, please feel free to reach out to us at info@solveadvisors.com or +1 646-699-5041.