Our weekly newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a weekly period.

- Top 10 Loan Price Winners

- Top 10 Loan Price Losers

- Average Bid Price (By industry sector)

- Market Sentiment

- Top Quote Volume Movers

- Most Quoted Loans

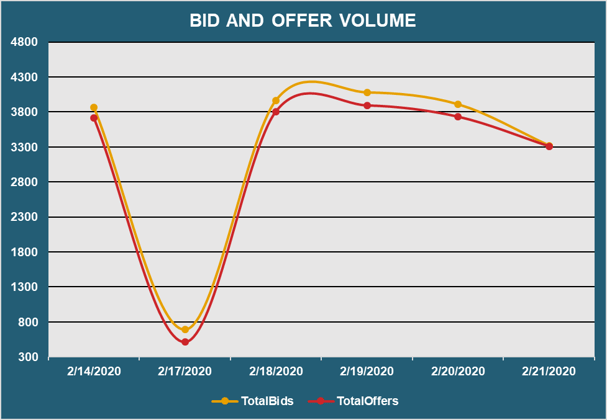

- Bid and Offer Volume

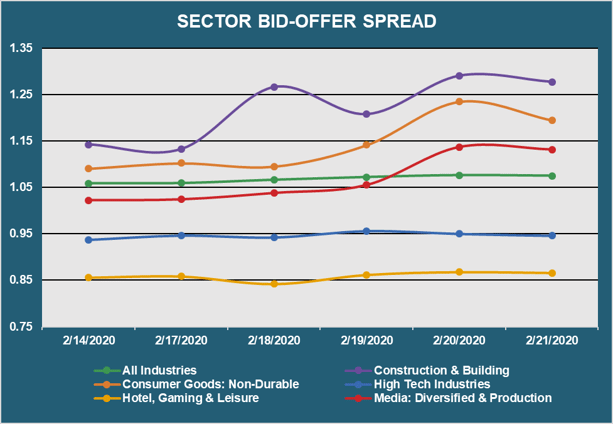

- Bid Offer Spread (By industry sector)

| TOP 10 WINNERS | ||||

| Rank | Loan | Chg | Price | Price - 1W |

| 1 | STEAK N SHAKE TL | 12.61% | 80.29 | 71.29 |

| 2 | TECHNICOLOR EUR TL B | 5.73% | 93.00 | 87.97 |

| 3 | DOUGLAS HOLDING EUR TL B8 | 4.30% | 92.74 | 88.92 |

| 4 | ADVANTAGE SALES 2ND LIEN TL | 3.00% | 94.78 | 92.02 |

| 5 | DIEBOLD TL A1 | 2.92% | 108.64 | 105.56 |

| 6 | TRITECH SOFTWARE SYSTEMS 2ND LIEN TL | 2.35% | 95.56 | 93.37 |

| 7 | EXELA TL B | 2.17% | 41.31 | 40.43 |

| 8 | ADVANTAGE SALES TL | 2.10% | 98.84 | 96.81 |

| 9 | PROGREXION TL | 2.07% | 47.41 | 46.45 |

| 10 | ALVOGEN TL B | 2.01% | 92.01 | 90.19 |

- Showcases the top 10 loan "winners" based on the largest bid price increases between 2/14/20 - 2/21/20

| TOP 10 LOSERS | ||||

| Rank | Loan | Chg | Price | Price - 1W |

| 1 | ALLIANCE HEALTH TL B | -9.21% | 88.64 | 97.63 |

| 2 | CONSOL MINING TL B | -6.31% | 79.65 | 85.01 |

| 3 | SPEEDCAST TL B | -5.07% | 70.91 | 74.69 |

| 4 | SERTA SIMMONS TL | -4.46% | 59.75 | 62.54 |

| 5 | SIVANTOS TL B | -4.36% | 95.18 | 99.53 |

| 6 | TIVITY HEALTH TL B | -3.77% | 96.16 | 99.93 |

| 7 | KETTLE CUISINE TL | -3.09% | 94.98 | 98.00 |

| 8 | PERSTORP TL | -2.47% | 95.67 | 98.08 |

| 9 | LIGHTSTONE GENERATION LLC TL C | -2.26% | 89.88 | 91.96 |

| 10 | REVLON TL B | -2.04% | 73.94 | 75.48 |

- Showcases the top 10 loan "losers" based on the largest bid price decreases between 2/14/20 - 2/21/20

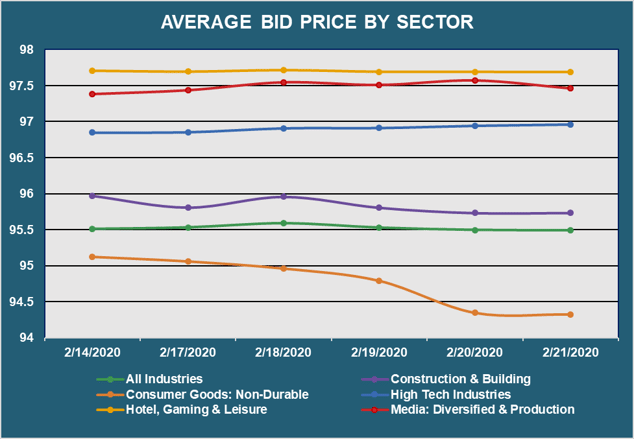

- Displays the average loan bid price by sector between 2/14/20 - 2/21/20

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

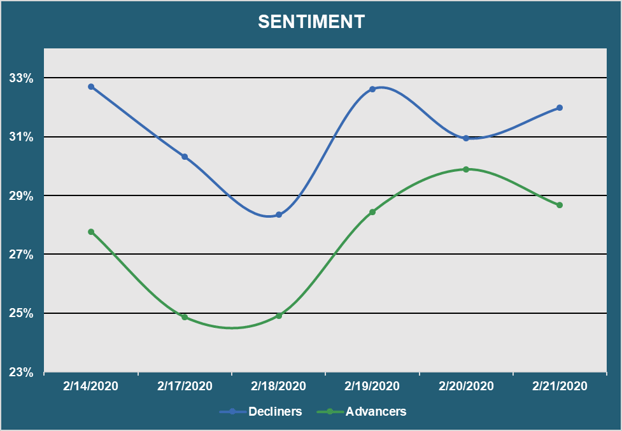

- Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 2/14/20 - 2/21/20

| TOP QUOTE VOLUME MOVERS: THIS WEEK vs LAST WEEK | |||||

| RANK | TRANCHE |

PRIOR WEEK |

THIS WEEK |

INCREASE | % INCREASE |

| 1 | MISTER CAR WASH TL B | 12 | 30 | 18 | 150% |

| 2 | AMER SPORTS EUR TL B | 14 | 26 | 12 | 86% |

| 3 | RPI INTERMEDIATE FINANCE TL B | 8 | 20 | 12 | 150% |

| 4 | BERRY PLASTICS TL W | 20 | 30 | 10 | 50% |

| 5 | COMPASS IV LTD EUR TL B | 14 | 24 | 10 | 71% |

| 6 | DELACHAUX EUR TL B1 | 14 | 24 | 10 | 71% |

| 7 | MESSER INDUSTRIES EUR TL B | 18 | 28 | 10 | 56% |

| 8 | WHATABURGER TL B | 14 | 23 | 9 | 64% |

| 9 | WINDSTREAM SERVICES LLC TL B7 | 12 | 21 | 9 | 75% |

| 10 | WINDSTREAM SERVICES LLC DIP REV | 0 | 8 | 8 | N/A |

- Exhibits the loans with the largest increase in quote volume for the week ending 2/14/20 vs. the week ending 2/21/20

| MOST QUOTED LOANS | ||

| RANK | TRANCHE | DEALERS |

| 1 | WEBHELP EUR TL B | 17 |

| 2 | ACTION NEDERLAND EUR TL B | 17 |

| 3 | VERISURE MIDHOLDING AB EUR TL B1 | 16 |

| 4 | SIGMA BIDCO EUR TL B | 16 |

| 5 | UNITED NATURAL FOODS TL B | 16 |

| 6 | ASCENA RETAIL TL B | 15 |

| 7 | ALPHA BIDCO EUR TL B1 | 15 |

| 8 | CEVA SANTE ANIMALE EUR TL B | 15 |

| 9 | ELSAN GROUPE EUR TL B | 15 |

| 10 | TECHEM EUR TL B | 15 |

- Ranks the loans that were quoted by the highest number of dealers between 2/14/20 - 2/21/20

- Reveals the total number of quotes by bid and offer between 2/14/20 - 2/21/20

- Displays the bid-offer spread by sector between 2/14/20 - 2/21/20

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Want free access to Real-Time Composite pricing and trends within the market for Syndicated Bank Loans?

If you would like to see additional information, or if you have any feedback or questions, please feel free to reach out to us at info@solveadvisors.com or +1 646-699-5041.