Our weekly newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a weekly period.

- Top 10 Loan Price Winners

- Top 10 Loan Price Losers

- Average Bid Price (By industry sector)

- Market Sentiment

- Top Quote Volume Movers

- Most Quoted Loans

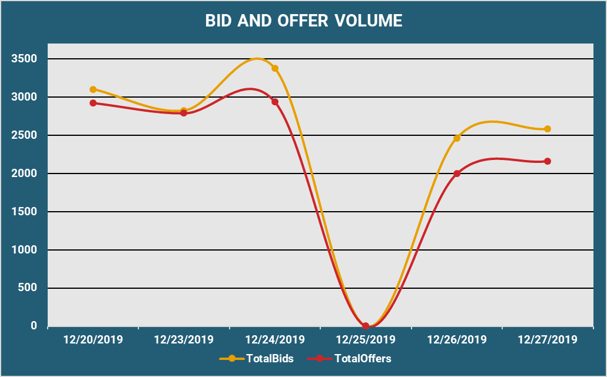

- Bid and Offer Volume

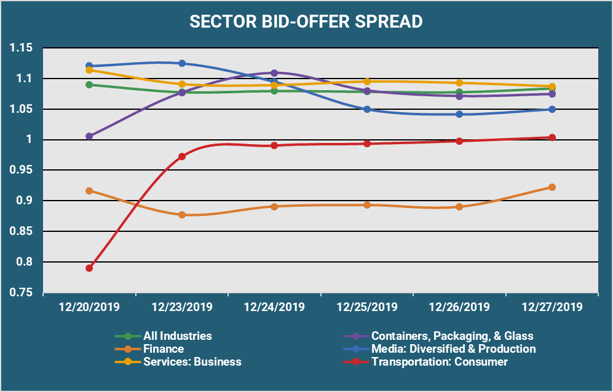

- Bid Offer Spread (By industry sector)

| TOP 10 WINNERS | ||||

| Rank | Loan | Chg | Price | Price - 1W |

| 1 | KLOECKNER TL B | 7.66% | 89.64 | 83.26 |

| 2 | EAGLECLAW TL B | 4.31% | 91.82 | 88.03 |

| 3 | CHECKERS TL | 2.50% | 67.31 | 65.66 |

| 4 | LIBBEY GLASS TL B | 1.61% | 79.64 | 78.38 |

| 5 | CAMPING WORLD TL B | 1.52% | 94.23 | 92.82 |

| 6 | MITEL NETWORKS 2ND LIEN TL | 1.41% | 74.09 | 73.06 |

| 7 | LIGHTSQUARED EXIT PIK TL | 1.27% | 63.03 | 62.25 |

| 8 | INFORMATION RESOURCES TL B | 1.26% | 97.32 | 96.11 |

| 9 | M/A-COM TECHNOLOGY SOLUTIONS TL B | 1.24% | 94.99 | 93.83 |

| 10 | TALLGRASS TL B | 1.16% | 98.99 | 97.86 |

- Showcases the top 10 loan "winners" based on the largest bid price increases between 12/20/19 - 12/27/19

| TOP 10 LOSERS | ||||

| Rank | Loan | Chg | Price | Price - 1W |

| 1 | AMERICAN ENERGY MARCELLUS EXIT TL | -3.90% | 92.67 | 96.43 |

| 2 | LEARFIELD TL | -2.87% | 87.99 | 90.59 |

| 3 | NEUSTAR 2ND LIEN TL B | -2.50% | 84.20 | 86.37 |

| 4 | HOLLEY PURCHASER TL | -1.71% | 93.35 | 94.97 |

| 5 | NBTY TL | -1.42% | 95.21 | 96.58 |

| 6 | TECHNICOLOR TL B | -1.21% | 84.39 | 85.42 |

| 7 | COOPER STANDARD TL B | -1.20% | 93.26 | 94.39 |

| 8 | LESLIE'S POOLMART TL B | -0.73% | 94.00 | 94.69 |

| 9 | GLASS MOUNTAIN PIPELINE TL B | -0.50% | 87.36 | 87.79 |

| 10 | GTT COMMUNICATIONS EUR TL B | -0.49% | 93.86 | 94.32 |

- Showcases the top 10 loan "losers" based on the largest bid price decreases between 12/20/19 - 12/27/19

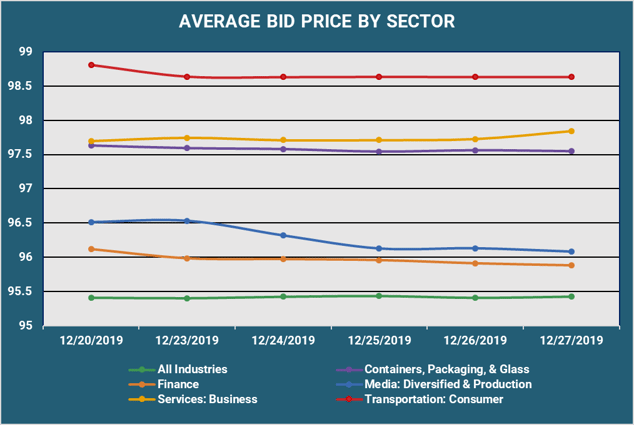

- Displays the average loan bid price by sector between 12/20/19 - 12/27/19

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

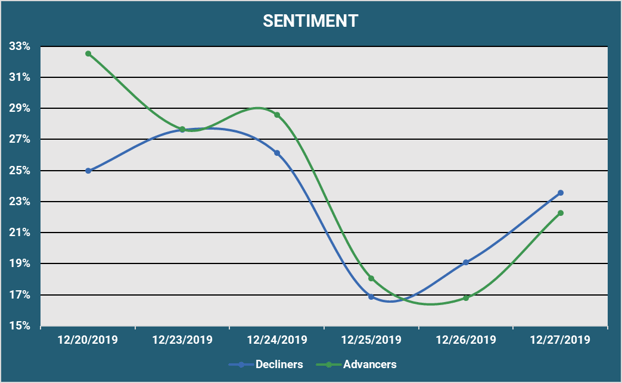

- Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 12/20/19 - 12/27/19

| TOP QUOTE VOLUME MOVERS: THIS WEEK vs LAST WEEK | |||||

| RANK | TRANCHE |

PRIOR WEEK |

THIS WEEK |

INCREASE | % INCREASE |

| 1 | MACDERMID TL B | 4 | 16 | 12 | 300% |

| 2 | LIFESCAN TL | 0 | 11 | 11 | N/A |

| 3 | BAUSCH HEALTH COMPANIES INC. TL B | 23 | 33 | 10 | 43% |

| 4 | TNT CRANE TL | 8 | 16 | 8 | 100% |

| 5 | PAREXEL INTERNATIONAL TL | 10 | 17 | 7 | 70% |

| 6 | ADVANCED DISPOSAL TL B | 18 | 25 | 7 | 39% |

| 7 | LIFESCAN 2ND LIEN TL | 0 | 7 | 7 | N/A |

| 8 | ONE CALL EXT TL B | 10 | 17 | 7 | 70% |

| 9 | FLYNN RESTAURANT TL | 0 | 7 | 7 | N/A |

| 10 | GRIFOLS WORLDWIDE TL B | 30 | 37 | 7 | 23% |

- Exhibits the loans with the largest increase in quote volume for the week ending 12/20/19 vs. the week ending 12/27/19

| MOST QUOTED LOANS | ||

| RANK | TRANCHE | DEALERS |

| 1 | HARLAND CLARKE TL B7 | 14 |

| 2 | WEST CORP TL B1 | 14 |

| 3 | BERRY PLASTICS TL U | 14 |

| 4 | RACKSPACE HOSTING TL B | 13 |

| 5 | SEADRILL PARTNERS LLC EXT TL B | 13 |

| 6 | VERISURE MIDHOLDING AB EUR TL B1 | 13 |

| 7 | CALPINE CORP TL B5 | 13 |

| 8 | WEBHELP EUR TL B | 13 |

| 9 | ASCENA RETAIL TL B | 12 |

| 10 | NTL CABLE PLC EUR TL O | 12 |

- Ranks the loans that were quoted by the highest number of dealers between 12/20/19 - 12/27/19

- Reveals the total number of quotes by bid and offer between 12/20/19 - 12/27/19

- Displays the bid-offer spread by sector between 12/20/19 - 12/27/19

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Want free access to Real-Time Composite pricing and trends within the market for Syndicated Bank Loans?

If you would like to see additional information, or if you have any feedback or questions, please feel free to reach out to us at info@solveadvisors.com or +1 646-699-5041.