Our weekly newsletter presents key trends derived from observable Syndicated Bank Loan pricing data over a weekly period.

- Top 20 Largest Loans

- Top 10 Loan Price Winners

- Top 10 Loan Price Losers

- Average Bid Price (By industry sector)

- Market Sentiment

- Top Quote Volume Movers

- Most Quoted Loans

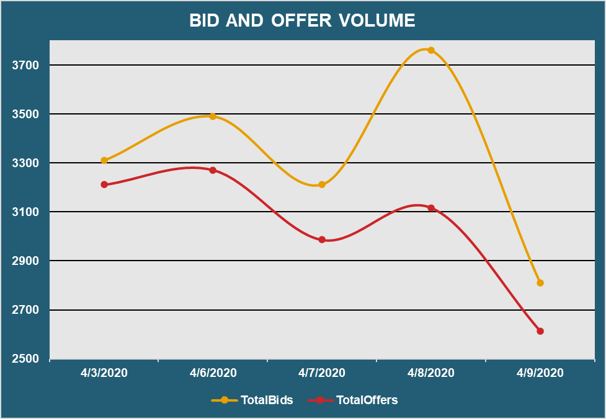

- Bid and Offer Volume

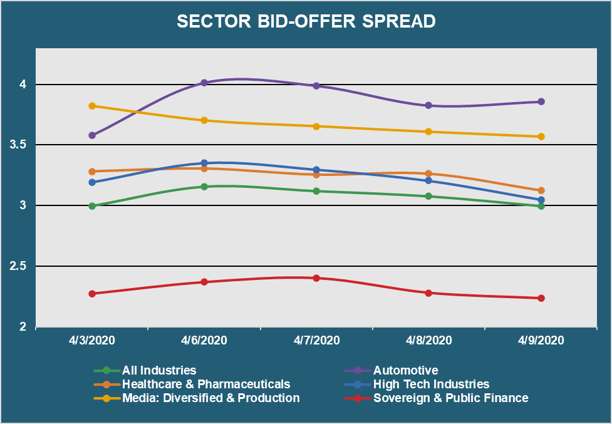

- Bid Offer Spread (By industry sector)

| LARGEST LOANS | ||||||

| Rank | Size (MM) | Name | Chg | Price | Price - 1W | Dealers |

| 1 | 5,450 | ENVISION HEALTHCARE TL B | 12.48% | 55.74 | 49.55 | 15 |

| 2 | 4,750 | DELL TL B | 3.17% | 97.75 | 94.75 | 12 |

| 3 | 4,700 | CAESARS RESORT COLLECTION TL | 4.43% | 86.08 | 82.43 | 12 |

| 4 | 4,250 | BERRY PLASTICS TL Y | 1.90% | 96.61 | 94.80 | 12 |

| 5 | 3,861 | PETSMART CONSENTED TL B2 | 2.16% | 97.20 | 95.15 | 12 |

| 6 | 3,582 | MISYS TL B | 7.86% | 87.94 | 81.53 | 12 |

| 7 | 3,575 | STARS GROUP TL B | 2.29% | 96.61 | 94.45 | 10 |

| 8 | 3,415 | ENDO HEALTH TL B | 5.64% | 91.91 | 87.00 | 10 |

| 9 | 3,325 | CINEWORLD TL B | 2.49% | 66.38 | 64.77 | 16 |

| 10 | 3,300 | BMC SOFTWARE TL B | 5.73% | 86.03 | 81.37 | 15 |

| 11 | 3,300 | NTL CABLE PLC TL N | 2.48% | 95.31 | 93.00 | 12 |

| 12 | 3,300 | DIAMOND SPORTS TL B | -2.04% | 72.42 | 73.94 | 10 |

| 13 | 3,275 | SCIENTIFIC GAMES TL B5 | 7.22% | 83.30 | 77.70 | 13 |

| 14 | 3,210 | HUB INTL LTD TL B | 2.15% | 93.60 | 91.63 | 10 |

| 15 | 3,165 | MULTIPLAN TL B | 5.44% | 92.02 | 87.28 | 12 |

| 16 | 3,161 | JAGUAR HOLDING CO I TL | 2.51% | 97.68 | 95.29 | 12 |

| 17 | 2,918 | AVAYA TL B | 10.16% | 91.54 | 83.10 | 10 |

| 18 | 2,902 | FORMULA ONE TL B | 5.00% | 92.30 | 87.91 | 12 |

| 19 | 2,851 | INTEL TL | 5.09% | 96.94 | 92.25 | 11 |

| 20 | 2,825 | BRAND ENERGY TL | 3.93% | 82.78 | 79.65 | 10 |

| AVERAGE | 3,556 | 4.50% | 88.01 | 84.38 | 11.9 | |

- Highlights the weekly price movements and quote depth for the 20 largest bank loans

| TOP 10 WINNERS | ||||

| Rank | Loan | Chg | Price | Price - 1W |

| 1 | SWISSPORT TL B | 29.70% | 64.87 | 50.01 |

| 2 | BUCCANEER 2ND LIEN TL | 19.36% | 37.47 | 31.39 |

| 3 | FLINT GROUP TL C | 19.25% | 74.84 | 62.76 |

| 4 | NEUSTAR 2ND LIEN TL B | 17.73% | 56.77 | 48.22 |

| 5 | ORYX SOUTHERN TL B | 16.40% | 65.35 | 56.14 |

| 6 | DELEK TL B | 16.28% | 84.64 | 72.79 |

| 7 | VYAIRE MEDICAL TL B | 14.20% | 79.94 | 70.00 |

| 8 | SIVANTOS TL B | 13.18% | 85.27 | 75.34 |

| 9 | DOUGLAS HOLDING EUR TL B1 | 13.00% | 60.15 | 53.23 |

| 10 | GVC HOLDINGS TL B | 12.93% | 96.36 | 85.33 |

- Showcases the top 10 loan "winners" based on the largest bid price increases between 4/3/20 - 4/9/20

| TOP 10 LOSERS | ||||

| Rank | Loan | Chg | Price | Price - 1W |

| 1 | TOWN SPORTS TL B | -49.31% | 21.80 | 43.00 |

| 2 | IMAGINA MEDIA AUDIOVISUAL SL 2ND LIEN EUR TL | -24.85% | 46.90 | 62.41 |

| 3 | LEARNING CARE TL B | -20.74% | 62.01 | 78.24 |

| 4 | PROGREXION TL | -16.13% | 37.97 | 45.26 |

| 5 | UNIFRAX TL B | -13.80% | 67.45 | 78.25 |

| 6 | KETTLE CUISINE TL | -11.22% | 70.94 | 79.90 |

| 7 | BLUESTEM EXT TL B | -10.57% | 50.92 | 56.94 |

| 8 | PEAK 10 2ND LIEN TL | -9.72% | 36.00 | 39.87 |

| 9 | COLORADO BUYER 2ND LIEN TL | -9.47% | 30.35 | 33.52 |

| 10 | LEARFIELD TL | -9.19% | 63.33 | 69.74 |

- Showcases the top 10 loan "losers" based on the largest bid price decreases between 4/3/20 - 4/9/20

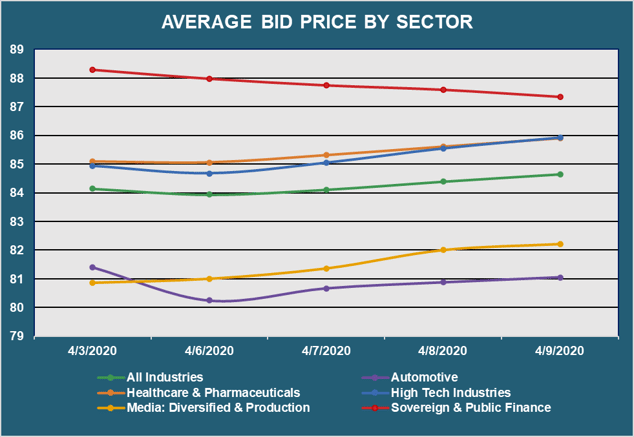

- Displays the average loan bid price by sector between 4/3/20 - 4/9/20

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

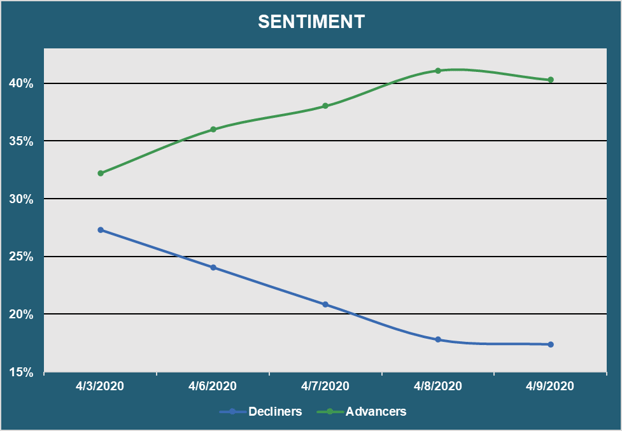

- Reveals the percent of loans increasing in price (advancers) vs. loans decreasing in price (decliners) between 4/3/20 - 4/9/20

| TOP QUOTE VOLUME MOVERS: THIS WEEK vs LAST WEEK | |||||

| RANK | TRANCHE |

PRIOR WEEK |

THIS WEEK |

INCREASE | % INCREASE |

| 1 | EPIQ SYSTEMS TL B | 22 | 46 | 24 | 109% |

| 2 | WTG HOLDINGS TL | 0 | 18 | 18 | N/A |

| 3 | QUORUM HEALTH TL | 0 | 16 | 16 | N/A |

| 4 | CAMPING WORLD TL B | 41 | 55 | 14 | 34% |

| 5 | LIFEPOINT HOSPITALS TL B | 20 | 33 | 13 | 65% |

| 6 | USI HOLDINGS TL B | 12 | 25 | 13 | 108% |

| 7 | WENDY'S INTERNATIONAL, LLC TL B | 19 | 31 | 12 | 63% |

| 8 | TOTAL SAFETY TL | 12 | 24 | 12 | 100% |

| 9 | BURGER KING TL B | 26 | 38 | 12 | 46% |

| 10 | DYNCORP TL B | 2 | 13 | 11 | 550% |

- Exhibits the loans with the largest increase in quote volume for the week ending 4/3/20 vs. the week ending 4/9/20

| MOST QUOTED LOANS | ||

| RANK | TRANCHE | DEALERS |

| 1 | ENVISION HEALTHCARE TL B | 18 |

| 2 | TRANSDIGM INC. TL F | 18 |

| 3 | CINEWORLD TL B | 17 |

| 4 | VERISURE EUR TL B1 | 17 |

| 5 | EIRCOM FINCO SARL EUR TL B | 17 |

| 6 | AMERICAN AIRLINES TL B | 17 |

| 7 | HILTON TL B | 17 |

| 8 | PARTY CITY TL B | 16 |

| 9 | BMC SOFTWARE TL B | 16 |

| 10 | GTT COMMUNICATIONS TL B | 16 |

- Ranks the loans that were quoted by the highest number of dealers between 4/3/20 - 4/9/20

- Reveals the total number of quotes by bid and offer between 4/3/20 - 4/9/20

- Displays the bid-offer spread by sector between 4/3/20 - 4/9/20

- Results are based on 5 select industry sectors, however, we offer data across 36 sectors

Want free access to Real-Time Composite pricing and trends within the market for Syndicated Bank Loans?

If you would like to see additional information, or if you have any feedback or questions, please feel free to reach out to us at info@solveadvisors.com or +1 646-699-5041.