We are excited to launch a weekly newsletter to highlight trends in the Municipal Bond market. Our newsletter presents key trends derived from observable Municipal Bond pricing data over a weekly period.

- Top 10 Muni Bond Winners & Losers

- Top 10 Muni State Winners & Losers

- 10 Yr Yield by State - All Muni

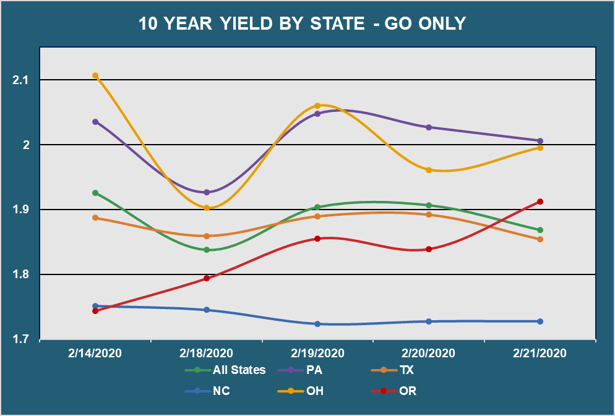

- 10 Yr Yield by State - GO Only

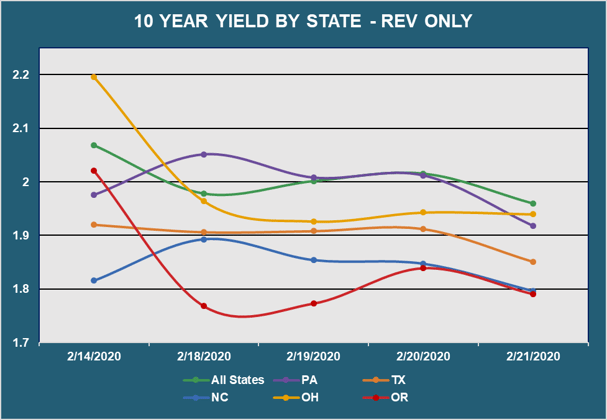

- 10 Yr Yield by State - REV Only

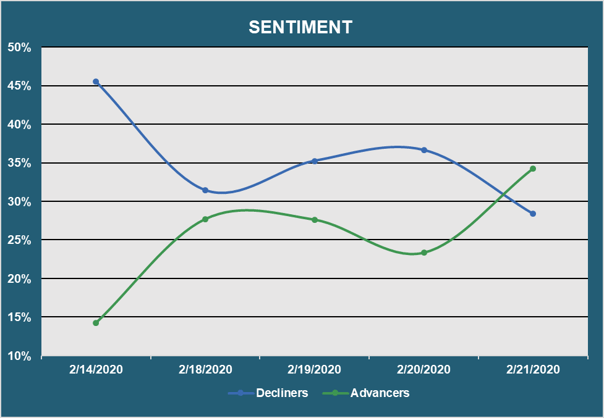

- Market Sentiment

- Top Quote Volume Movers

- Most Quoted Municipal Bonds

| TOP 10 BOND WINNERS | ||||||

| Rank | Bond Name | Coupon | Maturity | Chg | Price | Price - 1W |

| 1 | NY CONVENTN CTR-B-AGM | 0.00% | 11/15/48 | 6.36% | 48.61 | 45.70 |

| 2 | W HARRIS CNTY TX REGL | 3.00% | 12/15/58 | 3.73% | 105.44 | 101.65 |

| 3 | PORT AUTH-174TH | 4.46% | 10/01/62 | 3.62% | 137.96 | 133.14 |

| 4 | BALDWIN PK SCH-QSCB | 7.00% | 06/01/27 | 3.37% | 128.59 | 124.41 |

| 5 | SC PUB SVC AUTH-C-TXB | 5.78% | 12/01/41 | 3.36% | 133.80 | 129.46 |

| 6 | KERMAN USD-CABS-2008 | 0.00% | 08/01/42 | 3.20% | 56.33 | 54.58 |

| 7 | OHIO-A-REF-ADMIN BLDG | 5.00% | 10/01/24 | 3.14% | 111.61 | 108.21 |

| 8 | BEAUMONT USD-C-CABS | 0.00% | 08/01/44 | 2.84% | 50.77 | 49.36 |

| 9 | METRO TRANSP AUTH-A1 | 5.25% | 11/15/56 | 2.76% | 121.13 | 117.88 |

| 10 | COLORADO ST HLTH FACS | 3.80% | 11/01/44 | 2.51% | 109.06 | 106.39 |

| TOP 10 BOND LOSERS | ||||||

| Rank | Bond Name | Coupon | Maturity | Chg | Price | Price - 1W |

| 1 | PINAL CNTY AZ INDL DE | 7.25% | 10/01/33 | -4.65% | 102.23 | 107.22 |

| 2 | PR HWY/TRN-L-REF-AGC | 5.25% | 07/01/41 | -3.05% | 114.25 | 117.84 |

| 3 | DASNY -REV - F | 3.19% | 02/15/43 | -2.69% | 104.82 | 107.71 |

| 4 | SAN FRAN PT COMM-TXBL | 7.41% | 03/01/30 | -2.35% | 100.45 | 102.88 |

| 5 | MASSACHUSETTS ST DEV | 5.00% | 07/01/42 | -1.77% | 113.29 | 115.33 |

| 6 | PR HWY/TRN-CC-AGM | 5.50% | 07/01/30 | -1.37% | 116.44 | 118.05 |

| 7 | TN SCH BD AUTH-QSCB | 1.52% | 09/15/26 | -0.97% | 95.98 | 96.92 |

| 8 | DASNY-GROUP2-SER1-REV | 3.00% | 07/01/34 | -0.94% | 109.49 | 110.54 |

| 9 | PA HSG FIN AGY-A | 3.50% | 04/01/49 | -0.87% | 107.75 | 108.69 |

| 10 | PHILADELPHIA GAS-REF | 4.00% | 10/01/37 | -0.86% | 111.63 | 112.60 |

- Showcases the top 10 Muni Bond "Winners" and "Losers" based on price movements between 2/14/20 - 2/21/20

| TOP 10 STATE WINNERS | ||||

| Rank | State Name | Chg | Yld | Yld - 1W |

| 1 | NH | -37 bps | 1.57% | 1.94% |

| 2 | WI | -30 bps | 1.57% | 1.87% |

| 3 | MD | -29 bps | 1.51% | 1.80% |

| 4 | MO | -27 bps | 1.61% | 1.88% |

| 5 | KS | -24 bps | 2.11% | 2.35% |

| 6 | CT | -21 bps | 1.95% | 2.16% |

| 7 | NY | -21 bps | 1.81% | 2.02% |

| 8 | DE | -21 bps | 1.56% | 1.76% |

| 9 | SC | -19 bps | 1.64% | 1.83% |

| 10 | UT | -16 bps | 1.41% | 1.57% |

| TOP 10 STATE LOSERS | ||||

| Rank | State Name | Chg | Yld | Yld - 1W |

| 1 | WA | 20 bps | 1.93% | 1.72% |

| 2 | OR | 17 bps | 1.91% | 1.74% |

| 3 | NV | 15 bps | 1.84% | 1.69% |

| 4 | MT | 15 bps | 1.72% | 1.58% |

| 5 | AL | 6 bps | 1.96% | 1.89% |

| 6 | MS | 5 bps | 1.91% | 1.85% |

| 7 | DC | 3 bps | 1.79% | 1.75% |

| 8 | AR | 2 bps | 1.95% | 1.93% |

| 9 | GA | 1 bps | 1.75% | 1.74% |

| 10 | CA | 1 bps | 1.85% | 1.84% |

- Showcases the top 10 Muni State "Winners" and "Losers" based on yield movements between 2/14/20 - 2/21/20

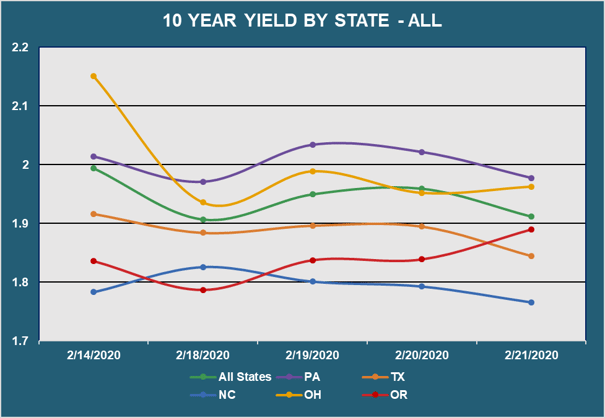

- Displays the average Muni 10 year yield by state between 2/14/20 - 2/21/20 (General Obligation and Revenue Bonds)

- Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

- Displays the average Muni 10 year yield by state between 2/14/20 - 2/21/20 (General Obligation Bonds only)

- Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

- Displays the average Muni 10 year yield by state between 2/14/20 - 2/21/20 (Revenue Bonds only)

- Results are based on 5 select states, however, we offer data across all 50 states and U.S. territories

- Reveals the percent of Muni bonds increasing in price (Advancers) vs. decreasing in price (Decliners) between 2/14/20 - 2/21/20

| TOP QUOTE VOLUME MOVERS: THIS WEEK vs LAST WEEK | |||||||

| RANK | TRANCHE | COUPON | MATURITY |

PRIOR WEEK |

THIS WEEK |

INCREASE | % INCREASE |

| 1 | ALAMEDA CORRIDOR-A | 5.00% | 10/01/24 | 23 | 55 | 32 | 139% |

| 2 | COLUMBIA -A -WTR SWR | 5.00% | 02/01/49 | 21 | 49 | 28 | 133% |

| 3 | WASHINGTON ST | 5.00% | 08/01/29 | 21 | 46 | 25 | 119% |

| 4 | MASSACHUSETTS ST DEV | 5.00% | 10/01/26 | 6 | 31 | 25 | 417% |

| 5 | SAN ANTONIO -REV | 5.00% | 02/01/41 | 7 | 31 | 24 | 343% |

| 6 | AR RIVER PWR AUTH-REF | 5.00% | 10/01/33 | 22 | 44 | 22 | 100% |

| 7 | S JERSEY PORT-B-AMT | 5.00% | 01/01/48 | 7 | 28 | 21 | 300% |

| 8 | WASHINGTON CNTY-B | 3.00% | 06/01/31 | 20 | 41 | 21 | 105% |

| 9 | NYS DORM AUTH-B-GRP C | 5.00% | 02/15/37 | 5 | 25 | 20 | 400% |

| 10 | SEATTLE -REV -A | 5.00% | 04/01/34 | 7 | 27 | 20 | 286% |

- Exhibits the Munis with the largest increase in quote volume for the week ending 2/14/20 vs. the week ending 2/21/20

| MOST QUOTED MUNIS | ||||

| RANK | TRANCHE | COUPON | MATURITY | DEALERS |

| 1 | MA DEV FIN AGY -A-1 | 5.00% | 07/01/50 | 18 |

| 2 | WALLER ISD | 4.00% | 02/15/44 | 17 |

| 3 | COLUMBIA -A -WTR SWR | 5.00% | 02/01/49 | 16 |

| 4 | SALT RIVER AZ PROJ AG | 5.00% | 01/01/47 | 16 |

| 5 | ILLINOIS ST-D | 5.00% | 11/01/26 | 14 |

| 6 | MET NASHVILLE TN ARPT | 4.00% | 07/01/49 | 13 |

| 7 | HARRIS CO FLOOD-REF | 5.00% | 10/01/26 | 13 |

| 8 | DASNY-A-GROUP 2-REF | 5.00% | 03/15/28 | 12 |

| 9 | MECKLENBURG CNTY NC | 4.00% | 03/01/32 | 12 |

| 10 | CHARLES CNTY | 4.00% | 10/01/32 | 12 |

- Ranks the Munis that were quoted by the highest number of dealers between 2/14/20 - 2/21/20

Want free access to Solve's Real-Time Market Data and trends within the market for Municipal Bonds?

If you would like to see additional information, or if you have any feedback or questions, please feel free to reach out to us at info@solveadvisors.com or +1 646-699-5041.